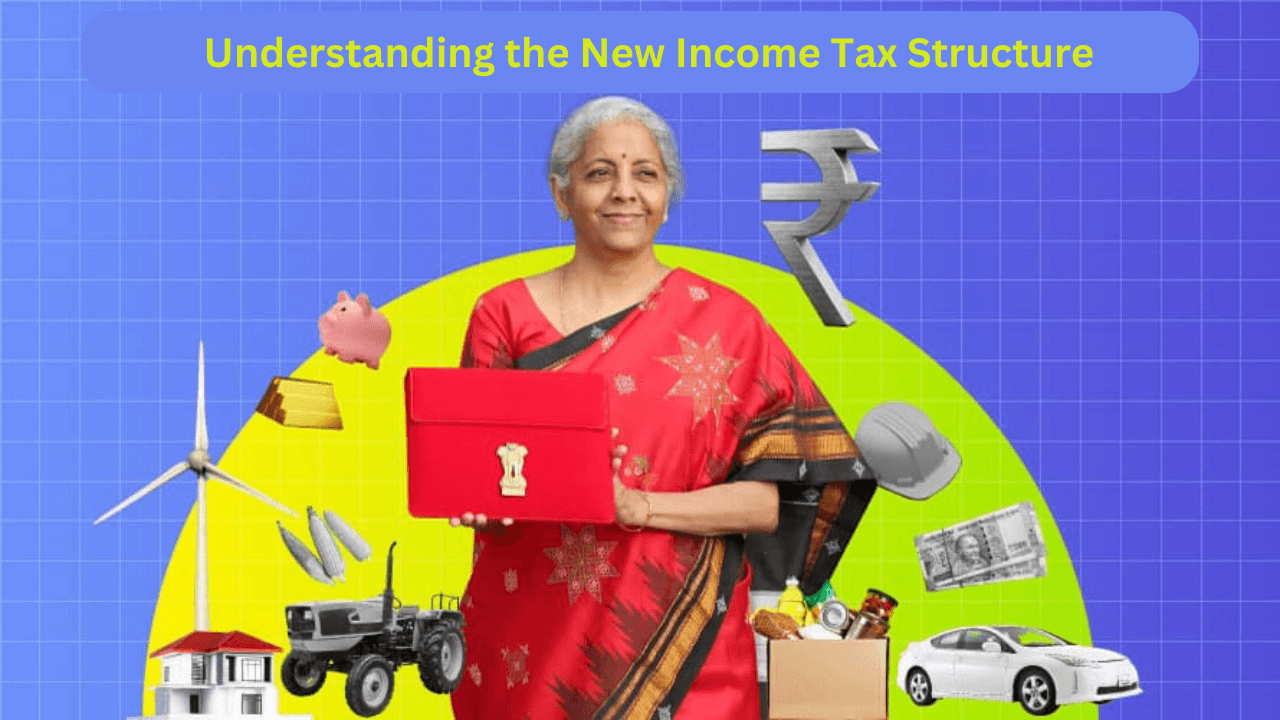

NEW DELHI: In a significant move to provide relief to the middle class, Finance Minister Nirmala Sitharaman announced a revised income tax structure under the new tax regime, making income up to Rs 12 lakh tax-free. Salaried individuals will benefit from an even higher exemption limit of Rs 12.75 lakh, factoring in a standard deduction of Rs 75,000.

However, confusion arises soon after the budget speech. DMK MP Dayanidhi Maran criticized the budget, pointing out that while Sitharaman initially announced no tax up to Rs 12 lakh, she later introduced a 10% tax slab for income between Rs 8-12 lakh. Many social media users etched similar concerns, questioning the seeming contradiction.

Decoding the New Tax Structure

The government has restructured tax slabs while increasing the exemption limit. Here’s how the new rates apply:

- Nil tax for income up to Rs 4 lakh

- 5% tax for income between Rs 4 lakh and Rs 8 lakh

- 10% tax for income between Rs 8 lakh and Rs 12 lakh

- 15% tax for income between Rs 12 lakh and Rs 16 lakh

- 20% tax for income between Rs 16 lakh and Rs 20 lakh

- 25% tax for income between Rs 20 lakh and Rs 24 lakh

- 30% tax for income above Rs 24 lakh

No Tax Up to Rs 12 Lakh — Here’s What It Really Means

While the government has promised zero tax up to Rs 12 lakh, the tax slabs remain relevant for those earning beyond this threshold. The rebate applies only if taxable income remains within Rs 12 lakh.

For instance, if an individual earns Rs 13 lakh annually, the tax is calculated as follows:

- Total income: Rs 13,00,000

- Standard deduction: Rs 75,000

- Taxable income: Rs 12,25,000

Now, the slabs apply:

- Up to Rs 4 lakh: No tax

- Rs 4 lakh – Rs 8 lakh: 5% on Rs 4 lakh = Rs 20,000

- Rs 8 lakh – Rs 12 lakh: 10% on Rs 4 lakh = Rs 40,000

- Rs 12 lakh – Rs 12.25 lakh: 15% on Rs 25,000 = Rs 3,750

Total tax = Rs 63,750 + 4% health & education cess

Thus, the moment taxable income surpasses Rs 12 lakh, the rebate is no longer applicable, and tax is charged from Rs 4 lakh onwards.

How Much Do Taxpayers Save?

With the new slabs, taxpayers stand to gain substantial benefits:

- A person earning Rs 12 lakh saves Rs 80,000 in tax

- A person earning Rs 18 lakh saves Rs 70,000

- A person earning Rs 25 lakh saves Rs 1.10 lakh

The revised tax structure simplifies compliance and offers relief to middle-class taxpayers while ensuring higher earners contribute their fair share. However, the tax slab structure has left some confusion, prompting calls for further clarification.