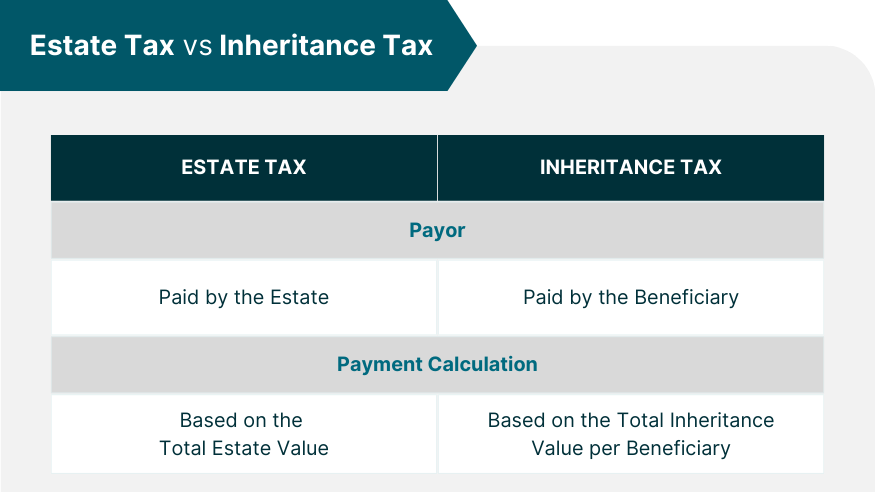

Inheritance tax, also known as the ‘death tax’, is a duty imposed on property inherited by an individual. The topic has sparked heated debates in the current Lok Sabha campaign, with political parties like Congress and BJP accusing each other of plans to revive it.

The Estate Duty Act was introduced in 1953, placing a tax on the principal value of both movable and immovable property passed on after the death of an owner. This law was abolished in 1985 by then-Prime Minister Rajiv Gandhi due to its unpopularity.

Current Political Discourse Around Inheritance Tax

The inheritance tax has resurfaced as a contentious issue in politics. Remarks by Indian Overseas Congress chairman Sam Pitroda have ignited discussions on the potential revival of this tax, contrasting sharply with vehement denials from the Congress party and accusations from Prime Minister Narendra Modi regarding the opposition’s intentions.

Unlike India, many countries around the world, including those in Europe and Asia, continue to impose significant inheritance taxes. This section provides a comparison, highlighting countries like France, Germany, and Japan, where inheritance taxes can be quite high.

Gift and Wealth Taxes: Companions to Inheritance Tax

India’s history with taxes related to wealth transfer includes the Gift Tax Act of 1958 and the wealth tax introduced in 1957. Though both were eventually abolished (gift tax in 1998 and wealth tax in 2015), they share similarities with the inheritance tax in their intent and challenges.

Debates and Proposals for Reintroducing Inheritance Tax

There have been intermittent calls for the reintroduction of inheritance tax in India, particularly during economic discussions by influential figures such as P Chidambaram and Arun Jaitley. These discussions highlight the tax’s potential role in addressing wealth inequality but also underscore the challenges of its implementation.

As the Lok Sabha elections approach, the debate over inheritance tax underscores deeper issues of wealth distribution and fiscal policy in India. While there are no immediate plans to reintroduce the tax, the ongoing political dialogue suggests that the discussion is far from over, indicating that the topic may re-emerge in future fiscal debates.